Access and affordability to quality healthcare are the challenges facing healthcare delivery in Africa. The challenges of high costs, long wait times, inadequate infrastructure, and migrating healthcare personnel currently prevent people from seeking medical attention when due.

Source: Businessday NG

Overall, with these challenges, largely preventable illnesses and delayed treatment cause poor health outcomes in the African communities. This is why Wellahealth Africa offers unique healthcare packages (micro insurance plans) that tackle healthcare access and affordability to improve the African healthcare delivery landscape.

Why Micro-health insurance?

Micro-health insurance is affordable health coverage for essential medical services designed for people on low, irregular incomes or regular incomes. Unlike traditional health insurance models, which can be costly and complex, micro health insurance caters to the specific needs of populations by offering tailored packages at minimal premiums.

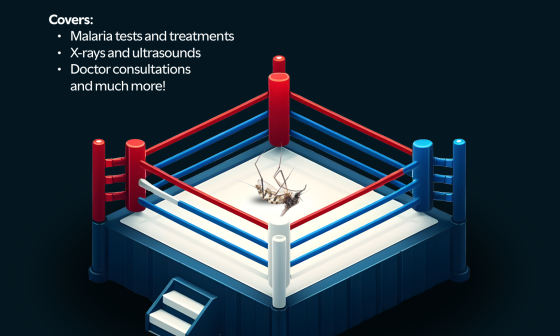

Micro-health plans aim to offer financial protection against unexpected medical costs. With Wellahealth Africa, you can pay a small, regular premium (for as low as #1700) and gain access to a range of healthcare benefits, that include:

- Consultation with doctors and healthcare professionals,

- Diagnostic tests (bedside/chair side and laboratory),

- Treatment for common illnesses (malaria and typhoid),

- Discounted medication

The Healthcare plans at WellaHealth

WellaHealth Africa’s micro health insurance movement is leveraging technology and innovation to redefine healthcare delivery in Africa. Through strategic partnerships with local healthcare providers WellaHealth has provided a robust ecosystem that connects individuals with the care they need.

The key strength of WellaHealth’s approach is its digital approach which facilitates easy enrollment, claims processing, and provider payments with utmost efficiency. By harnessing the power of mobile technology via telemedicine, the barriers to accessing healthcare are significantly reduced, empowering individuals to take control of their health and well-being.

The Wellahealth plans are subscribed monthly, quarterly, six-monthly, or yearly all depending on individual preference.

● Basic health plan:

The basic health plan per individual is #1700 quarterly individual, #3400 6-monthly, and #6800 yearly. It covers :

- Consultation with doctors,

- Tests for diabetes and hypertension,

- Diagnostic tests for malaria, and

- Discounted medications for malaria.

● HospiCash health plan:

The hospicash plan per individual costs #2300 quarterly, #4,600 6-monthly, and #9200 yearly. This plan covers:

- Consultation with doctors,

- Tests for diabetes and hypertension,

- Diagnostic tests for malaria and typhoid,

- Discounted medications for malaria and typhoid,

- Hospitalization costs, and

- Funeral payouts in case of death.

● Micro health plan:

Micro health plan by Wellahealth costs #1200 monthly, #3600 quarterly, and #14,400 yearly. This plan covers:

- Consultations with healthcare professionals,

- Diagnostic tests for malaria, typhoid, and other uncomplicated febrile illnesses,

- Discounted medications

- Antenatal care and delivery after 12 months on the plan,

- Accident and Emergency care for up to #50,000,

- Treatment of health issues to the tune of #25,000,

- Surgical care; incision and drainage of abscesses, wound dressing, and suturing of minor cuts,

- Management of simple skin diseases and diarrheal diseases,

- Management and treatment of fungal, parasitic, viral, and uncomplicated bacterial infection

Benefits of WellaHealth Africa’s Insurance Plans

Benefits of choosing WellaHealth Africa insurance plans:

- Affordable: Insurance plans are designed to be accessible for everyone regardless of income.

- Flexible: Individuals can choose a plan that fits their needs and budget.

- Convenient: Subscribers can access healthcare services at WellaHealth’s network of partnered clinics and telemedicine healthcare providers.

- Peace of mind: Subscribers have peace of mind and can focus on other life activities knowing fully well they are covered, thereby reducing financial stress in case of illness.

- Focus on common conditions: WellaHealth Africa often starts by focusing on prevalent and preventable diseases in Africa, such as malaria.

How do I subscribe to Wellahealth’s plans?

To get accessible and affordable health plans for yourself and your family for little cost send us a message on WhatsApp today or visit our website: www.wellahealth.com!

Dr. Ifeoma Uduh, Dr. John Afam